In a diplomatic effort to strengthen the European Union’s stance on sanctions against Russia, David O’Sullivan, the EU sanctions envoy, visited Kazakhstan and Uzbekistan this week. The EU sanctions, encompassing nearly 1,800 individuals and entities, target a broad spectrum, including Russian elites, oligarchs, defence sector companies, political parties, and media organisations. These measures, comprising travel bans, asset freezes, and import/export restrictions, along with the prohibition of EU service exports, reflect a robust EU response to the war in Ukraine.

Despite the strength and scope of the sanctions, the EU has highlighted the need for broader collaboration to enhance their effectiveness. The diplomatic mission to Kazakhstan and Uzbekistan is strategically focused on addressing challenges related to the circumvention of Russian sanctions by non-EU nations, with a particular emphasis on the issues surrounding dual-use weapons and technology.

How do EU-Russia trade relations look like today?

The EU has implemented a comprehensive set of economic sanctions targeting Russia’s domestic and trade economy. These measures aim to exert pressure on Russia while mitigating adverse effects on EU businesses and citizens. The sanctions encompass both import and export restrictions on specified goods, strategically designed to maximise impact on the Russian economy while safeguarding essential areas like health, pharmaceuticals, food, and agriculture to protect the well-being of the Russian population.

Export restrictions prohibit EU entities from selling certain products to Russia, while import restrictions prevent Russian entities from selling specific products to the EU. Additionally, the EU, in collaboration with like-minded partners, has issued a joint statement reserving the right to cease treating Russia as a most-favoured-nation within the World Trade Organization framework.

Specific goods whose export from Russia to the EU is prohibited include: cutting-edge technology, machinery, transportation equipment, items crucial for oil refining, energy industry equipment, aviation and space industry goods, maritime navigation goods, dual-use goods, luxury goods, civilian firearms, and other items that could enhance Russian industrial capacities.

On the flip side, the list of sanctioned products that cannot be imported from Russia to the EU encompasses crude oil (effective December 2022) and refined petroleum products (effective February 2023) with limited exceptions, as well as more goods like steel and iron products, gold (including jewelry), plastics, liquor, cigarettes, and cosmetics.

What’s special about dual-use goods?

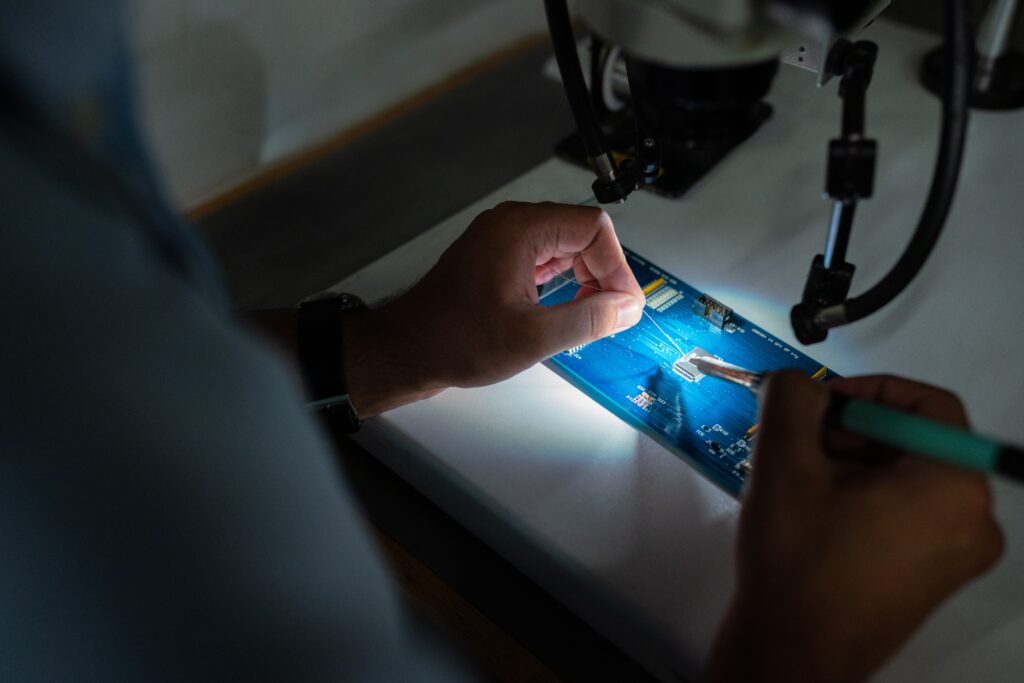

Dual-use goods play a critical role in various industries due to their ability to serve both civil and military functions. These goods, which include items like drones and encryption devices, are hi-tech and value-adding to the economy, standing at the frontier of technological advancement. From a civilian perspective, dual-use technologies contribute to the growth of sectors such as communications, transportation, and information technology, fostering economic development and societal progress. Simultaneously, these items may have strategic importance in military contexts, bolstering national defence capabilities.

Why Central Asia?

The role of Kazakhstan and Uzbekistan is particularly significant in light of their non-alignment with EU sanctions. The primary objective of the EU visit is to prevent these countries from becoming platforms for the evasion or circumvention of sanctions imposed on Russia.

Through careful research, the EU has found that there have been noticeable spikes in activities related to the re-export of goods. Many EU exports destined for non-EU states are nevertheless finding their way in substantial quantities to Russia. This is confirmed by the fact that some of these goods are found in the remnants of Russian missiles and armaments found on the battlefields of Ukraine. The EU effort to minimise the potential for Russia to sidestep sanctions, however, faces complexity when it comes to the re-export of dual-use products.

While the EU seeks to discourage partner countries, like Kazakhstan and Uzbekistan and more non-aligned countries, from re-exporting dual-use goods to Russia, it is forced to tread a delicate line. Not only do many of the non-aligned countries share historical, cultural, and economic ties with Russia, but the EU currently opposes any extraterritorial application of sanctions. Thus diplomatic efforts by the EU are currently focused on encouraging countries to refrain from becoming involved as a country that allows Russia to circumvent EU sanctions. This approach amplifies the impact of EU sanctions: increasing the costs for Russia, both economically and strategically, and denying the Russian government access to goods for its military industry.

Moving forward

Looking ahead, the EU is preparing its 12th package of Russian sanctions. Anticipating potential complicity in Russian efforts to circumvent sanctions, the EU is poised to employ economic penalties against third countries. A key tool in their arsenal is the authority to sanction and freeze assets of entities and businesses involved in circumvention, even in the absence of proof of criminal conviction within the EU. Meanwhile, there is a list of companies that EU businesses are prohibited from doing business with.

Implications for Governments

- Strategic alignment: Governments are currently asked to coordinate and foster a united front against Russia’s circumvention attempts. They are also pressured to create enduring diplomatic alliances in the long-term, ensuring sustained alignment with the evolving nature of sanctions and promoting a cohesive international stance.

- Regulatory cooperation: Governments efforts would be enhanced should they collaborate closely with at-risk companies, offering regulatory guidance and support to ensure compliance with EU sanctions and minimise the risk of re-exportation. This can happen by developing proactive strategies, such as industry-specific guidelines and joint monitoring initiatives.

Implications for Private Firms

- Risk assessment: firms will have to navigate the complexities of sanctions, providing insights into potential legal pitfalls and helping develop strategies to minimise the risk of criminal liability.

- Due diligence: Firms are pressured to establish and reinforce robust due diligence processes, scrutinising business partners, suppliers, and clients to identify any potential connection to sanctioned entities or activities. Implementing continuous monitoring mechanisms can help firms stay vigilant against any emerging risks related to sanctions evasion, enabling timely adjustments to business strategies in response to evolving geopolitical scenarios.

In sum, governments may likely consider strategic alignment against Russia’s sanctions circumvention and regulatory collaboration with at-risk firms. Private firms can prepare for more sanction by conducting risk assessments, establishing due diligence processes, and employing continuous monitoring to minimise liability and adapt to geopolitical changes.